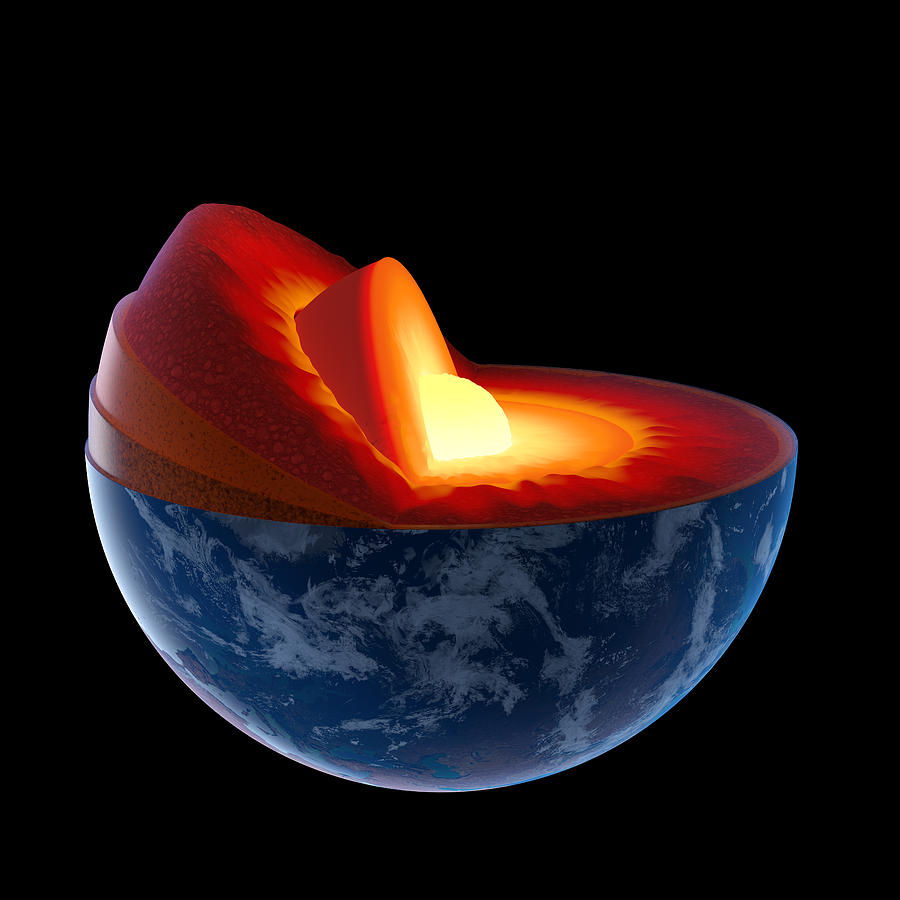

Getting around by car is a big part of many lives, and knowing you have the right kind of protection for your vehicle is a very big deal. Think about the heart of anything, that central, most important piece. Just like the core of an apple holds its seeds, or the core of a planet is its central mass, there's a fundamental part to car protection that every driver ought to know about. This central part, this basic and most important piece, is what we call core auto insurance. It’s the very foundation of keeping you and your vehicle safe on the roads, and frankly, it’s something everyone who drives a car needs to understand.

For many folks, figuring out car protection can feel a bit like trying to solve a puzzle, especially with all the different choices out there. You might hear lots of terms, and it’s easy to feel a little lost about what truly matters. What we want to talk about today is that central, innermost part of vehicle protection, the kind that gives you the basic safety net you really need. It’s not about all the fancy extras; it’s about the very heart of what makes sense for most drivers. This is the part that, you know, makes sure you are covered for the big, common things that can happen.

So, we are going to explore what this essential car coverage means for you, and how it acts as the basic, most important part of your driving peace of mind. We will look at what it generally includes, why it matters so much, and how it can give you that foundational feeling of safety when you are out and about. It’s a pretty straightforward idea once you get down to it, and it helps to have a clear picture of this main element of car safety. People are really looking for simpler ways to handle things these days, and knowing about this basic protection fits right into that desire for clarity and ease, apparently.

Table of Contents

- What is Core Auto Insurance?

- Why Core Coverage Matters So Much

- Key Components of Core Auto Insurance

- Who Needs Core Auto Insurance?

- Getting the Right Core Plan for You

- Frequently Asked Questions About Core Auto Insurance

- Making Your Choice for the Road Ahead

What is Core Auto Insurance?

When we talk about core auto insurance, we are really talking about the central, most important part of your car protection plan. Think of it like the basic structure of a house; you have the walls, the roof, and the foundation, which are all absolutely necessary for it to stand. Core auto insurance is that fundamental structure for your vehicle. It is the minimum set of protections that most states require you to have, and it covers the most common and significant risks you face while driving, so it’s pretty important. It’s the very basic and most important part of something, you know, like the heart of the issue.

This kind of protection is not about every possible thing that could happen, but rather the hard central part of what you need to be a responsible driver. It usually involves coverage that takes care of others if you cause an accident, and sometimes it helps with your own injuries too. It is the part that has to be understood before the whole thing can be understood or dealt with, very much like the core of a problem. This type of coverage is often the starting point, the foundation upon which you might choose to add more layers of protection, if you want to. It’s just the bare bones, the essential part, actually.

For example, in the world of online games, "Core offers polished game starter templates including team deathmatch, king of the hill, battle royale, dungeon crawler, racing, and more." These templates are the core, the basic framework from which creators can build endless experiences. Similarly, core auto insurance gives you that basic framework, the essential protection that allows you to drive legally and with some peace of mind. It's the central, innermost, or most essential part of something, which in this case, is your vehicle's safety plan. So, it is the absolute minimum you need, typically.

Why Core Coverage Matters So Much

Having core auto insurance is not just a legal requirement in most places; it is a very practical matter of personal security and financial well-being. Imagine, for a moment, getting into a fender bender without any protection. The costs could be enormous, covering damage to other vehicles, medical bills for injured people, and even legal fees if things go to court. Core auto insurance helps shield you from these potentially devastating financial blows, which is a really big deal. It acts like a financial safety net, so to speak.

Without this central piece of protection, a simple accident could easily wipe out your savings or put you deep into debt. It is the basic protection that helps you avoid those truly difficult situations. This kind of coverage is designed to handle the most common and impactful scenarios, making sure that if something goes wrong, you are not left to face it all by yourself. It is the heart, the soul, the bone of your vehicle safety plan. It helps you keep your mind at ease while you are out driving, which is pretty good, you know.

Consider the broader picture: researchers and the general public use tools to "find, discover and explore the wealth of open access research," with millions of papers available. The core of this system is providing access to essential information. Core auto insurance provides access to essential protection. It’s about having that basic, undeniable access to help when you need it most. It is about being a responsible driver and a considerate member of the community. In a way, it’s a shared responsibility that benefits everyone on the road, more or less.

Key Components of Core Auto Insurance

While the exact makeup of core auto insurance can change a little bit from one place to another, there are some parts that are almost always there. These are the main elements that form the central protection you get. Understanding these pieces helps you see what your basic plan is really all about. These are the parts that typically make up the core of what you are getting, and it's good to know what they are, basically.

Liability Protection: The Main Piece

This is, without a doubt, the most important part of core auto insurance. Liability protection covers damages and injuries you might cause to other people or their property if you are at fault in an accident. It has two main sections: bodily injury liability and property damage liability. Bodily injury liability helps pay for medical costs, lost wages, and pain and suffering for others. Property damage liability helps cover repairs or replacement of other people's cars or property. This is the very central section of your protection, honestly.

Think of it as the central, innermost part of your legal obligation when driving. If you cause an accident, this part of your protection steps in to help pay for the harm done to others. It is like the hard elastic core of a baseball; it is what gives the whole thing its bounce and ability to perform when hit. Without this part, you would be personally responsible for all those costs, and that could be a very big burden indeed. So, this is a truly fundamental piece of your policy, you know.

Personal Injury Protection (PIP) or Medical Payments (MedPay)

Some places require or offer Personal Injury Protection (PIP) or Medical Payments (MedPay) as part of their core coverage. These parts help pay for medical expenses for you and your passengers, no matter who caused the accident. PIP can also cover lost wages and other related costs, which is a rather helpful thing to have. It is a bit like having a basic health safety net for those in your car, which is quite nice.

This piece of the puzzle is designed to give immediate help for medical needs after a crash. It is not about who was at fault; it is about making sure that immediate care is available. This can be a very calming thing to have, knowing that your own medical bills or those of your passengers will get some help. It is another way the core coverage provides a basic and important part of your overall safety plan, in some respects.

Uninsured/Underinsured Motorist Coverage

This part of core auto insurance protects you if you are hit by a driver who does not have enough protection, or any protection at all. It helps cover your medical bills and sometimes even your vehicle damage if the other driver cannot pay. It is a very smart addition to your basic plan because, sadly, not everyone on the road carries enough protection, or any at all. This is a very real concern for many drivers, too, it's almost.

This coverage acts as an extra layer of safety, making sure that even if the other person is irresponsible, you are still looked after. It is like having a backup plan for a situation that is out of your control. This is a core element of truly protecting yourself from the unexpected actions of others. It gives you a sense of security, knowing that you have some recourse even in those less-than-ideal situations, which is pretty reassuring, honestly.

Who Needs Core Auto Insurance?

Basically, anyone who drives a car needs core auto insurance. If you own a vehicle and plan to drive it on public roads, you will almost certainly need this basic protection. Most states have laws that make it a requirement to have at least liability coverage, which is the main piece of core auto insurance. Not having it can lead to big fines, suspension of your driving privileges, and even jail time in some places. So, it is not just a good idea; it is usually a must-have, you know.

Even if your state does not strictly require it, having core auto insurance is a very sensible choice. The financial risks of driving without it are simply too high. Imagine hitting a very expensive car or causing serious injury to someone. Without core protection, you would be personally responsible for all those costs, which could be financially crippling. It is the basic protection that helps you avoid a truly difficult situation. It’s the central, innermost part of responsible vehicle ownership, really.

This is especially true for new drivers or those with older vehicles who might think they do not need much protection. The age of your car does not change the fact that you can still cause damage or injury to others. Core auto insurance is the fundamental safety net for everyone who gets behind the wheel. It is the basic and most important part of being a responsible driver, and it applies to pretty much everyone who uses a car on the road, apparently.

Getting the Right Core Plan for You

Choosing your core auto insurance does not have to be a difficult process. The first step is to understand what your state requires. These requirements set the minimum amount of protection you must carry. After that, you can think about your own situation. Do you drive a lot? Do you have many assets you want to protect? These questions can help you decide if you need a little more than the bare minimum, or if the core coverage is just right for you. It’s about finding that central balance, you know.

You can get quotes from several different providers to compare prices and what they offer. Do not be afraid to ask questions about what is included in their core plans and what the limits are for each type of protection. A good provider will be able to clearly explain everything to you. It is about finding the best fit for your needs and your wallet. This is where a little bit of looking around can really pay off, you know, actually.

Remember, the goal is to get that central, most important part of your vehicle protection in place. It is about securing the basic foundation. Think of it like crafting your unique digital persona, where you choose the core elements that define you. Similarly, you choose the core elements of your auto protection. You can learn more about vehicle safety on our site, and also check out tips on finding affordable protection. It is a pretty simple process once you know what to look for, basically.

Frequently Asked Questions About Core Auto Insurance

People often have questions about what core auto insurance really means for them. Here are some common things folks wonder about this basic protection:

What does core auto insurance cover?

Core auto insurance typically covers the most basic and important things: liability for injuries or damage you cause to others, and sometimes medical payments for yourself and your passengers, or protection if an uninsured driver hits you. It is the fundamental set of coverages that meets legal requirements and protects against major common risks. It's the central part of your protection, you know, the most essential bits.

Is core auto insurance enough?

Whether core auto insurance is enough truly depends on your personal situation and comfort level. For some, it meets the legal requirements and provides a basic safety net. For others, especially those with newer cars or significant assets, it might not be enough. They might want to add more protection like collision or comprehensive coverage. It is the basic, most important part, but sometimes you need more than just the core, you know, like the hard central part of certain fruits, containing the seeds, but you still eat the fruit around it.

What is the difference between core and full coverage auto insurance?

Core auto insurance is the basic, most important part, usually covering liability to others and maybe some personal injury protection. Full coverage, on the other hand, includes these core elements but also adds protection for your own vehicle, like collision coverage (for damage to your car in an accident) and comprehensive coverage (for damage from things like theft, fire, or natural events). Full coverage is like having all the extensions, components, and elements, while core is just the main part. It is a much broader shield for your vehicle, honestly.

Making Your Choice for the Road Ahead

Understanding core auto insurance is a really good step towards being a smart and safe driver. It is the basic and most important part of your vehicle safety plan, much like the core of an issue that has to be understood before the whole thing can be understood. By getting to know what this central protection offers, you can make choices that give you peace of mind every time you get behind the wheel. It is about having that essential piece in place, so you can focus on the road, which is a pretty good thing, actually. This fundamental protection is truly the heart of responsible driving, you know, for today, December 14, 2023.

Detail Author:

- Name : Americo Larson Sr.

- Username : ethan.cruickshank

- Email : uwaelchi@daugherty.biz

- Birthdate : 2000-02-25

- Address : 6831 Miles Crossing Ziemanntown, WA 96325

- Phone : 1-701-506-3547

- Company : Kling-Kub

- Job : Meter Mechanic

- Bio : Ab dolorum culpa sapiente tempora distinctio quia. Similique ipsa minima voluptatem perspiciatis rerum. Mollitia ut molestiae praesentium inventore cumque modi.

Socials

linkedin:

- url : https://linkedin.com/in/morgantoy

- username : morgantoy

- bio : Eum nemo perferendis et eum et.

- followers : 3544

- following : 2110

instagram:

- url : https://instagram.com/toym

- username : toym

- bio : Veniam quos quia praesentium quidem qui non. Ab amet ipsum adipisci illum et ex et.

- followers : 1422

- following : 515

tiktok:

- url : https://tiktok.com/@morgan_toy

- username : morgan_toy

- bio : Cumque aut eum atque dolorem voluptate dicta.

- followers : 248

- following : 2953

twitter:

- url : https://twitter.com/mtoy

- username : mtoy

- bio : Quia minus aut aliquid quam. Magnam maiores corporis veniam debitis vitae. Et quis excepturi ipsa fuga cupiditate. Itaque nulla enim facere mollitia omnis.

- followers : 4791

- following : 1029